Content

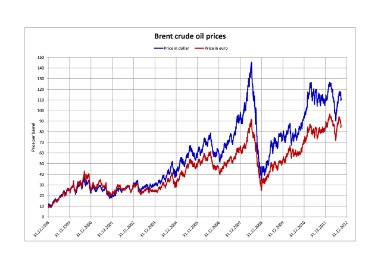

Long-term traders must keep a close eye on what the ECB is doing. The index fell in 2008 amid the global financial crisis and again during the global Covid-19 outbreak. CFDs are leveraged, so you can open a trade by making an initial deposit worth a fraction of the total value, known as margin. However, it’s important to remember that profits or losses for your trading are calculated on the full position size, not your margin amount. So, losses could substantially outweigh this initial amount and it’s vital to take steps to manage your risk.

When you hear analysts commenting on the performance of stock markets in Continental Europe, the German index is very likely the first one that will be mentioned. Indices are great for seeing how the biggest companies in the country perform. Alternatively, a more positive global risk sentiment may yield a trading environment that is bullish for European indices. In this case, the bulls would look to push the DAX 30 towards 15,300 where the 127.2% Fibonacci extension resistance of the coronavirus-fueled market retracement sits. Qontigo’s global index provider STOXX Ltd. announces that Linde plc will be deleted from the DAX index effective 27 February 2023.

Wechsel im DAX: Porsche ersetzt Puma

Any positions opened over the weekend are automatically rolled over to a weekday position after 7am Monday, but you’ll have to open any weekend positions separately from your weekday trades. You can trade the DAX index directly on its cash (spot) price using CFDs via our Germany 40 index. https://g-markets.net/helpful-articles/how-to-spot-fake-double-tops/ This is the most direct way to access the performance of the DAX via CFDs with us. The specification can be viewed on the corresponding page of the official website eurex.com. Please note that you can choose between regular DAX contracts and mini or micro versions for small cap traders.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The Germany 40 is the name for City Index’s market on the DAX. When you trade CFDs or spread bet on the DAX in the City Index platform, you’ll buy or sell our market called the ‘Germany 40’. Lots of factors might affect German stocks, and there is no guarantee that any event will have the expected impact on the index itself. That said, here are a few of the key factors that are worth considering when trading the DAX 40. The DAX’s price movements reflect the volatility seen by its constituents.

Events such as Brexit, the 2008 recession and the coronavirus pandemic are all capable of hitting market demand in one way or another. For instance, the pandemic in 2020 had a particularly outsized impact on key sectors such as aviation and banking, with Lufthansa and Deutsche Bank’s share prices plummeting in March 2020. When you trade a DAX future, you’re agreeing to buy or sell the index at a set price on a set date.

What Is the DAX 40 and How to Trade It?

Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. The main drive of the German stock index seems to be the European Central Bank and its monetary policy. First of all, Germany is one of the most significant exporters in the euro bloc, and German companies are happy when the euro declines against other currencies (most notably against the British Pound). As the ECB continues to print money and all the rates are kept at or below zero, the euro has very few reasons to strengthen.

- The value of an investment in stocks and shares can fall as well as rise, so you may get back less than you invested.

- This means that only shares that are available for trading are counted towards each company’s market cap.

- The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.

- The DAX 30 index experiences persistent long-term trends that last from a few months to a few years.

- Constituents must generally have their shares listed in the Prime Standard segment (a segment of the EU-regulated market) to comply with these criteria.

The vast majority of shares on the Frankfurt Exchange now trade on the all-electronic Xetra system, with a near-95% adoption rate for the stocks of the 40 DAX members. Performance is shown on a total return basis (i.e., with gross income reinvested, where applicable). Cumulative return is the aggregate amount that an investment has gained or lost over time. Annualized return is the average return gained or lost by an investment each year over a given time period. DAX delivers efficient access to 40 of the largest and most liquid publicly traded companies in Germany, spanning a range of economic sectors. Covering the global markets, AvaTrade gives you accurate daily analysis, trading tools, as well as a personal portfolio manager that will assist you in making informed DAX trading decisions.

How is the DAX 30 index calculated?

Traders should follow the general state of the German economy and news related to companies that are included in the index. SAP, for example, was the largest company in the DAX 40 by market cap when it suffered a 20% dip in October 2020 – which was a major contributor to the wider index falling 2.6%. To trade the DAX, you’ll need to use derivatives or ETFs that track the index’s price – you can’t trade it directly. Because like any stock index, the DAX is only a calculation of the values of a group of stocks. As a blue-chip stock market index, the DAX is very similar to the Dow Jones Industrial Average (DJIA), which also tracks large, publicly owned companies.

As we’ve already covered, the DAX is capitalisation-weighted. Companies with higher market caps are more capable of moving the index than smaller constituents. Remember that the DAX is only a number representing a group of stocks? An ETF is a fund that contains all those stocks, using them to track the price of the index itself. Alternatively, you can trade the individual DAX companies themselves. Over its history, the index has seen remarkably little volatility in its constituents – on its 40th birthday, 15 companies had been present on the index since its inception.

Similarly, a sell-off in the stock market will also trigger a fall in the stock index. In this article, we’ll cover the German DAX index, explain which stocks are included and how to trade the index. It tracks the performance of 30 blue-chip German companies trading on the Frankfurt Stock Exchange, and is the most widely used indicator of the country’s equity market. The companies in the DAX index span a wide range of industries. For example, Bayer AG is a pharmaceutical and consumer health company founded in 1863 and is well-known for its pain and allergy-relief products. Allianz SE is a global financial services company that focuses on providing customers with insurance and asset management products.

Learn first. Trade CFDs with virtual money.

The Financial Times Stock Exchange 100 index is a share index of the 100 highest market capitalisation companies on the London Stock Exchange. As well as being a trader, Milan writes daily analysis for the Axi community, using his extensive knowledge of financial markets to provide unique insights and commentary. The actual selection of the constituents is based on free-float market capitalisation, and this is reviewed quarterly. A single company cannot have an index weighting of more than 10%. To be included in the DAX 40, a company must first be listed in the Prime Standard segment on the Frankfurt Stock Exchange. Companies that belong to this segment have to meet higher standards of transparency than companies listed on the General Standard segment.

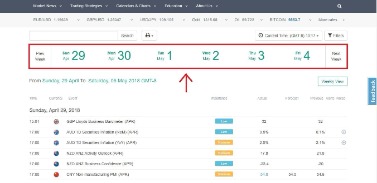

Moreover, the economic growth in the Eurozone has slowed recently, which could be another reason for the single currency to depreciate. Secondly, German economic numbers, such as GDP, retail sales, labor market figures, PMIs, etc. tend to have only a minimal immediate effect on the German DAX index. For intraday traders, its usually the actual daily sentiment which drives the price of this stock index, or technical analysis could come helpful as well. For long-term investors and traders, you need to monitor closely what the ECB is doing, and in times of monetary policy easing (such as nowadays), you might want to try buying any dips. It doesn’t look like we will see any other type of monetary policy soon, so that this strategy could be well used by investors now.

ETF Risk Stats As of 06/30/23

The Automobile sector with the two heavyweights Volkswagen and Daimler is next, followed by Pharma & Healthcare – together they make up roughly 20% of the index. What might happen from here is that the buyers will look to take out the February all-time high and eventually push the price above 14,000. In this regard, the bulls may look for a move to 14,500, where the 127.2% Fibonacci extension of the 2018 retracement is located. Get $25,000 of virtual funds and prove your skills in real market conditions. Harness the market intelligence you need to build your trading strategies.

- You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

- Indices are great for seeing how the biggest companies in the country perform.

- The companies are essentially classified as mid-caps and are drawn from various industries.

The NASDAQ 100 is a stock market index made up of 100 of the world’s largest non-financial companies listed on the Nasdaq stock exchange including Apple, Google, and Tesla. The DAX 40, also known as the DAX Index, is a blue-chip stock index following the largest German companies listed on the Frankfurt Stock Exchange. It’s also a reliable indicator of the country’s economic strength. It’s considered to be the benchmark stock market index for the German economy.

Other Trading Basics

You can buy CFDs to take a long position on the index, or sell them to take a short position. The DAX was created in 1987 with a base index value of 1,000. It broke through the 12,000 barrier for the first time in 2015. The composition of the index is regularly reviewed and companies can be removed if they no longer rank in the top 45 biggest firms. The DAX was founded in 1988, and the base value of the index at that time was 1,163.